WCC Demonstration Program Update December 2024

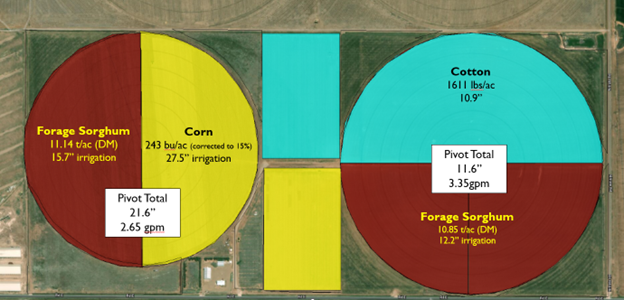

The yield results are in! Now we can start piecing together the story with regards to the most profitable use of water when sharing between crops. The main demonstration project at the Water Conservation Center (WCC) included forage sorghum as an alternative to the regular corn / cotton rotation to see how it might affect profitability. The previous rotation included planting the whole pivot to either corn or cotton and coming into the 2024 season, the west pivot was significantly drier due to the previous cotton crop taking far more moisture out of the soil. As such, there was approximately 3.5” extra irrigation applied to the west pivot to even out the starting moisture, so this needs to be considered when viewing the irrigation data in figure 1. This also meant that there was approximately the same amount of water applied to both forage sorghum crops within the growing season.

Figure 1. The 2024 planting map shows the locations of corn, cotton and forage sorghum on the east and west pivots at the WCC. This also shows the yield and amount of water applied to each crop during the 2024 season.

As you can see in Table 1, both the cotton and corn yields were very good when compared with previous field history at the WCC. Since this was the first forage sorghum crop grown there, there is no baseline, however the yields were comparable to other crops grown in the area. By simply multiplying the yield with the price received, it is obvious that corn gave the highest gross return per acre, closely followed by cotton. However, it should also be noted that the NET returns have not yet been calculated and the forage sorghum had the lowest growing costs compared to the other two crops. It is interesting to note that the gross return per inch pumped is very similar between forage sorghum and corn. This is on account of the much lower irrigation requirement of the male sterile forage sorghum compared to grain corn. Farming is about making money, and the NET returns will be key, but these results are highly encouraging, since they show that forage sorghum seems to be a very water efficient crop and could play a role in meeting the silage demand that seems to be ever-increasing in the north plains region. The inclusion of forage sorghum could play a key role in maintaining profitability when water is limited, and a full circle of corn may not be a viable option.

| Yield / ac | Price | Gross $/ac | Irrigation (in) | $/inch | |

| East Pivot – Cotton | 1612 lbs | $0.70* | $1,128 | 6.9 | $163.50* |

| East Pivot – Forage Sorghum | 10.88 t (dm) | $51.10 | $556 | 8.2 | $67.77 |

| West Pivot – Corn | 240 bu | $5.11 | $1,225 | 20 | $61.25 |

| West Pivot – Forage Sorghum | 11.16 t (dm) | $51.10 | $570 | 8.2 | $69.56 |

Table 1. Shows the gross returns based on the yield and price, as well as the in-season irrigation (note that the west pivot required 3.5” more pre-season irrigation to account for the previous cotton crop). It should be noted that that the cotton dried the soil approximately 6” more than the corn or sorghum so the irrigation will be closer to 12.9” and the $/inch should be ~$87).

It should be noted in Table 1 above, that the return per inch of water pumped for cotton is completely skewed, since cotton took approximately 6 inches more water out of the soil, compared to the other crops. If that was factored back into the equation, then the $/inch pumped would be closer to $87. This is still a great return, but the cotton yield was above average and the net returns are yet to be calculated.

The full results, including net economic returns, will be published in a NPGCD report in early 2025 and were also presented at the Pioneer meetings in early January. So stay tuned for a more detailed analysis in the February Newsletter.